Kèo Nhà cái ⭐️ Tỷ Lệ Kèo Nhà Cái Carreradereyes

Tỷ Lệ Kèo Nhà Cái Hôm Nay

Tỷ lệ kèo nhà cái là con số được nhà cái đưa ra để thể hiện khả năng chiến thắng của mỗi đội trong một trận đấu. Nó cũng là cơ sở để nhà cái tính toán số tiền thắng cược cho người chơi.

Tỷ lệ nhà cái, hay còn gọi là tỷ lệ cược, là con số thể hiện khả năng xảy ra của một sự kiện trong cá cược. Nó được nhà cái đưa ra dựa trên nhiều yếu tố như phong độ đội bóng, lịch sử thi đấu, cầu thủ ra sân, v.v.

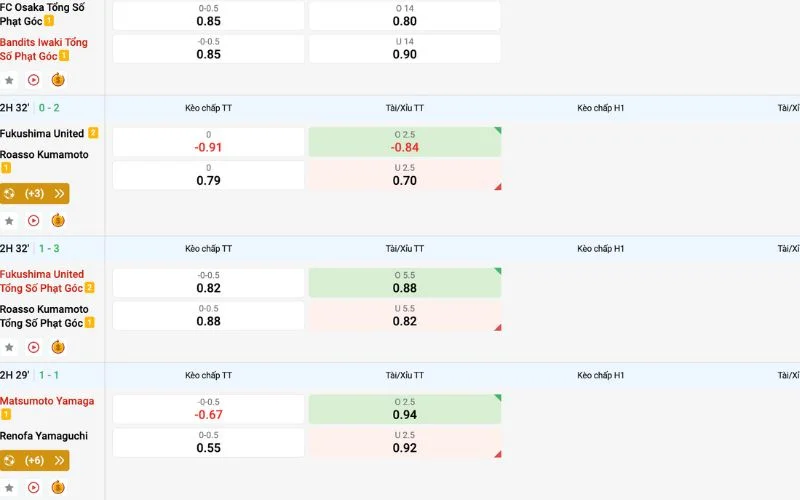

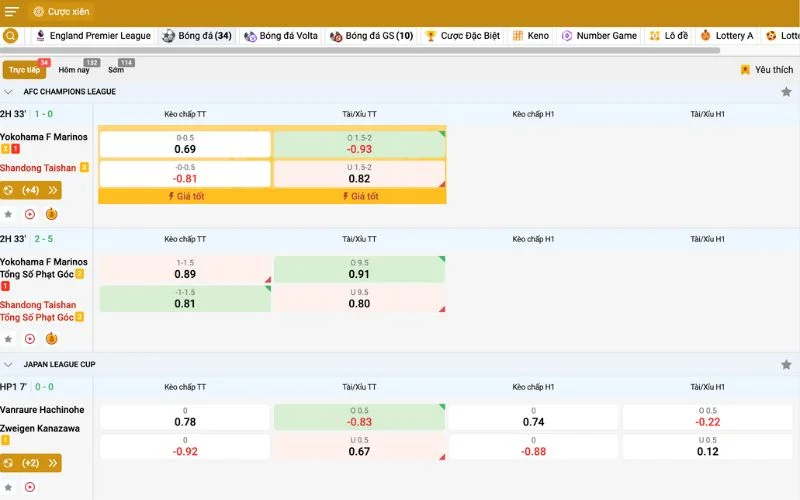

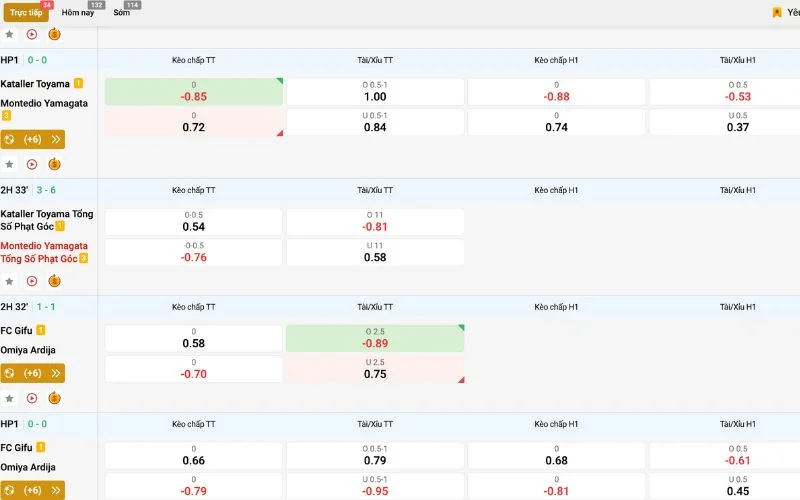

Tỷ Lệ Kèo Nhà Cái Carreradereyes là một trong những trang web cung cấp kèo nhà cái hôm nay, và được đánh giá rất cao do cung cấp tỷ lệ kèo bóng đá cạnh tranh chính xác. Với bảng tỷ lệ kèo nhà cái trực tuyến, bạn có thể theo dõi mọi diễn biến mới nhất chỉ trong vài giây: kèo nhà cái World Cup (WC), AFF Champion Cup, kèo châu Á, châu Âu, C1, C2, tỷ lệ tài xỉu cùng với các kèo phụ đa dạng và chính xác. Bảng tỷ lệ kèo 24/7 của Carreradereyes cung cấp đầy đủ thông tin về kèo bóng đá trong hiệp 1, hiệp 2, kèo tỉ số và liên tục cập nhật từ các giải đấu hot nhất như Ngoại Hạng Anh, La Liga, Cúp C1, v.v. Với tỷ lệ kèo nhà cái từ Carreradereyes, bạn có thể dễ dàng theo dõi và đánh giá tỷ lệ kèo nhà cái tối nay, bao gồm cả kèo tỷ số chi tiết nhất. Ngoài ra, thông qua kèo nhà cái trực tuyến, bạn cũng có thể tìm thấy các gợi ý kèo chính xác nhất. Sắp tới, chúng tôi sẽ cung cấp tỷ lệ kèo nhà cái cho Euro – giải đấu danh giá nhất Châu Âu, để bạn có thể theo dõi kèo trực tuyến 24/7 suốt mùa giải mà không bỏ lỡ bất kỳ cơ hội nào.

Tại Sao Là Kèo Nhà Cái “Carreradereyes”?

“Carreradereyes” trong tiếng Tây Ban Nha có nghĩa là “cuộc đua của các vị vua”, phản ánh tinh thần và đam mê mà chúng tôi muốn mang lại cho cộng đồng cá cược bóng đá. Tên gọi này không chỉ thể hiện sự nhiệt huyết và cam kết của chúng tôi trong việc cung cấp dịch vụ cá cược bóng đá hàng đầu, mà còn tôn vinh tinh thần thể thao và lòng quyết tâm của các cầu thủ trên sân cỏ. “Carreradereyes” là biểu tượng của sự chuyên nghiệp, đam mê và sự tôn trọng đối với trò chơi bóng đá.

Với tỷ lệ kèo nhà cái carreradereyes, chúng tôi tự hào mang đến cho bạn một trải nghiệm cá cược bóng đá chất lượng, đáng tin cậy và đầy đam mê. Hãy cùng chúng tôi tham gia vào cuộc đua của các vị vua và khám phá niềm đam mê bất tận với bóng đá.

>>>> Giới Thiệu Về Carreradereyes

Tỷ Lệ Kèo Nhà Cái là gì?

Tỷ lệ kèo nhà cái là một khái niệm quan trọng trong lĩnh vực Cá cược thể thao trực tuyến. Đơn giản, tỷ lệ kèo bóng đá là cách mà nhà cái xác định tỷ lệ chiến thắng cho mỗi lựa chọn cược trong một sự kiện thể thao cụ thể. Đây là một chỉ số quan trọng, không chỉ để người chơi đánh giá cơ hội chiến thắng mà còn để nhà cái đảm bảo lợi nhuận.

Tylekeo được biểu diễn dưới dạng số hoặc phân số, ví dụ: 1.5, 1.75, 1 1/2, 0.25,… Số này thường thể hiện tỷ lệ giữa số tiền mà người chơi có thể thắng được so với số tiền mà họ đặt cược. Ví dụ, nếu một trận đấu có tỷ lệ kèo là 2/1 cho đội A, tức là nếu bạn đặt cược 100 đơn vị và đội A thắng, bạn sẽ nhận được 200 đơn vị (bao gồm cả số tiền cược ban đầu) trong trường hợp này.

Tuy nhiên, ty le keo cũng phản ánh độ xác định của nhà cái về kết quả của sự kiện thể thao. Ví dụ, nếu một đội được coi là yếu hơn một đối thủ, tỷ lệ kèo cho đội yếu có thể cao hơn để khuyến khích người chơi đặt cược lên đội mạnh hơn và giảm thiểu rủi ro cho nhà cái.

Nhìn chung, tỷ lệ keonhacai là một công cụ quan trọng để người chơi đánh giá cơ hội chiến thắng và quyết định cách đặt cược của mình, trong khi cũng là một phần không thể thiếu của chiến lược kinh doanh của nhà cái.

Các Tỷ Lệ Kèo Nhà Cái quan trọng hiện nay:

Tỷ Lệ Kèo Nhà Cái châu Á

Patrocina